Estimated Quarterly Tax Payments Calculator Bench Accounting

Enter your debit or credit card information to authorize payment. You can also access an estimated tax worksheet in IRS Publication 505, Tax Withholding and Estimated Tax. See how your withholding affects your refund, take-home pay or tax due.

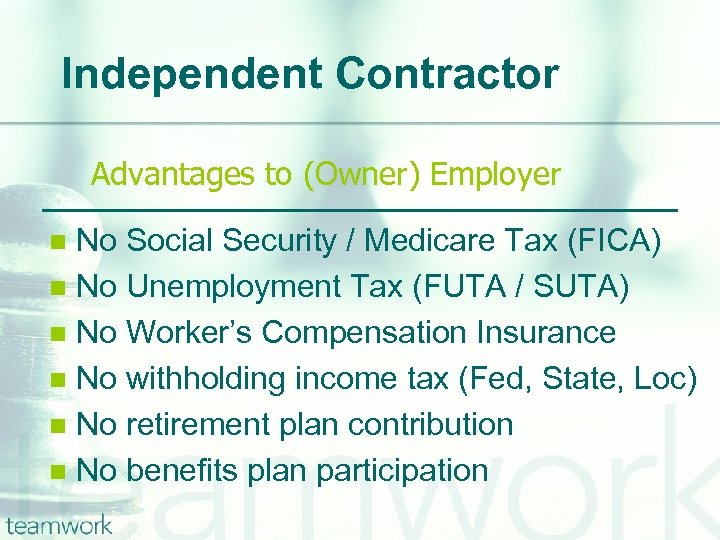

- However, the withholding tables couldn’t fully factor in other changes, such as the suspension of dependency exemptions and reduced itemized deductions.

- There are special rules for underpayment for farmers and fishermen.

- Based on the tax bracket you enter the calculator will also estimate tax as a percentage of your taxable income.

- Send us a payment or pay your estimated taxes in full on time to stop future penalties and interest from adding up.

- If you answered “no” to all of these questions, you must make estimated tax payments using Form 1040-ES.

The tax law lets you deduct a myriad of expenses, the most common of which are mortgage interest and medical expenses. If you have a honking big mortgage or big medical bills, it may be worthwhile to itemize your deductions. Itemized deductions are a list of eligible expenses that also reduce your taxable income. This is the total amount withheld from your paychecks and applied directly to your federal tax bill over the course of a year based on your W-4 allowances.

More In Pay

Doing so could help them avoid or lower a penalty because their required payment for one or more periods may be higher with this method. Using this tool to estimate tax withholding can help taxpayers avoid unpleasant surprises. Having too little withheld can result in a tax bill or even a penalty at tax time. Having too much withheld may result in a projected refund, which could mean less money in the taxpayer’s pocket during the year. The Tax Withholding Estimator can help taxpayers decide how much to withhold to get to a balance of zero or to a desired refund amount.

Quarterly self-employment taxes: How they work and how to calculate estimated payments – AS USA

Quarterly self-employment taxes: How they work and how to calculate estimated payments.

Posted: Thu, 13 Apr 2023 07:00:00 GMT [source]

There are special rules for underpayment for farmers and fishermen. To see if they owe a penalty, taxpayers should use Form 2210. If you don’t think you can afford your full tax bill, then you should pay as much as you can and contact the IRS. The agency may be able to offer you a few payment options to help you pay off your bill. For example, the IRS may offer a short-term extension or temporarily delay collection.

Here are some simple tips to help taxpayers:

The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has (hopefully) grown substantially. Federal income tax and FICA tax withholding are mandatory, so there’s no way around them unless your earnings are very low. However, they’re not the only factors that count when calculating your paycheck. One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

The “principal” is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. In 2022, the 28 percent AMT rate applies to excess AMTI of $206,100 for all taxpayers ($103,050 for married couples filing separate returns).

The “safe harbor” rule of estimated tax payments

If you elect to contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help with medical expenses, those contributions are deducted from your paychecks too. If you work for yourself, you need to pay the self-employment tax, which is equal to both the employee and employer portions of the FICA taxes (15.3% total). Luckily, when you file your taxes, there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

Typically, the IRS does not give payment or filing extensions for estimated taxes. If you’re a calendar year taxpayer and at least two-thirds of your gross income for 2022 or 2023 is from farming or fishing, you have only one payment due date for your 2023 estimated tax, January 16, 2024. The due dates for the first three payment periods don’t apply to you. See Farmers and Fishermen in Publication 505, Tax Withholding and Estimated Tax. Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck.

How to calculate mortgage payments

The most common pre-tax contributions are for retirement accounts such as a 401(k) or 403(b). So if you elect to save 10% of your income in your company’s 401(k) plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

Q1 Quarterly Estimated Tax Payments Due Jan. 17, 2023 – CPAPracticeAdvisor.com

Q1 Quarterly Estimated Tax Payments Due Jan. 17, 2023.

Posted: Wed, 11 Jan 2023 08:00:00 GMT [source]

Your total tax was zero if the line labeled “total tax” on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S Tax Return for Seniors was zero. Farmers, fishermen and people whose income is uneven during the year may have different rules. See Publication 505, Tax Withholding and Estimated Tax, for more information. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

We’ll search 500 tax deductions & credits to provide comprehensive coverage. There are numerous other credits, including credits for the installation of energy-efficient equipment, a credit for foreign taxes paid and a credit for health insurance payments in some situations. To avoid an overpayment or underpayment penalty, you can pay either at least How to calculate estimated taxes 90% of this year’s tax bill, or pay the same amount (100%) as the taxes you owed the prior year, whichever is smaller. And if you want help calculating your taxes, you can get straight to the tax preparation with our free estimated tax calculator. If you don’t pay enough during the year, you’ll owe interest on the tax due with your return.

So Stephanie’s self-employment tax total is $90,000 x 92.35% x 15.3%, which works out to $12,716.59. Stephanie can also deduct 50% of her self-employment tax of $12,716.59 (calculated below). Of course, if you overpay, the IRS will send you a refund check. We believe everyone should be able to make financial decisions with confidence.

If you don’t qualify for penalty removal or reduction due to retirement or disability, we can’t adjust the Underpayment of Estimated Tax by Individuals Penalty for reasonable cause. We may consider making an adjustment if we imposed the penalty after you relied on incorrect written advice we gave you. The date from which we begin to charge interest varies by the type of penalty. Interest increases the amount you owe until you pay your balance in full.

If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI). You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. The system allows you to track and monitor all electronic payments to the IRS.

You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. The IRS recommends that everyone do a paycheck checkup in 2019, even if they did one in 2018, to determine if they need to adjust their tax withholding or make estimated tax payments throughout the year. Although especially important for anyone with a tax bill for 2018, it’s also important for anyone whose refund is larger or smaller than expected. By changing withholding now or making estimated tax payments, any taxpayer can better ensure they get the refund they want next year. For those who owe, making estimated tax payments in 2019 is the best way to head off another tax-time surprise a year from now.

- Updated to include income tax calculations for 2022 form 1040 and, 2023 Estimated form 1040-ES, for status Single, Married Filing Jointly, Married Filing Separately, or Head of Household.

- If the total of your estimated payments and withholding add up to less than 90 percent of what you owe, you may face an underpayment penalty.

- When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point.

- Download the TaxCaster Tax Calculator App to your Android or iPhone.

- Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing.

Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 InstructionsPDF, for where to report the estimated tax penalty on your return. Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. For example, if you fall into the 25% tax bracket, a $1,000 deduction saves you $250.

Do you intend to file as a sole proprietor, partner, S corporation owner, shareholder, or self-employed individual? You will likely need to make estimated quarterly tax payments if you expect to owe $1,000 or more in taxes. Report all your estimated tax payments on Form 1040, line 26.