Catalog

Hassle Free Hotline

Dial - 0340 0997777

Pod Kits

-

Uwell Caliburn G3 Pro Pod Kit at Best Price

5.0 / 5.0

(6) 6 total reviews

Regular price From Rs.7,500.00 PKRRegular priceUnit price / perUwell Caliburn G3 Pro Pod Kit at Best Price

Regular price From Rs.7,500.00 PKRRegular priceUnit price / perUwell Caliburn G3 Pro Pod Kit at Best Price

Regular price From Rs.7,500.00 PKRRegular priceUnit price / per -

Oxva Xlim Sq Pro 2 Best Price In Pakistan

Regular price Rs.9,500.00 PKRRegular priceUnit price / perRs.10,500.00 PKRSale price Rs.9,500.00 PKROxva Xlim Sq Pro 2 Best Price In Pakistan

Regular price Rs.9,500.00 PKRRegular priceUnit price / perRs.10,500.00 PKRSale price Rs.9,500.00 PKROxva Xlim Sq Pro 2 Best Price In Pakistan

Regular price Rs.9,500.00 PKRRegular priceUnit price / perRs.10,500.00 PKRSale price Rs.9,500.00 PKRSale -

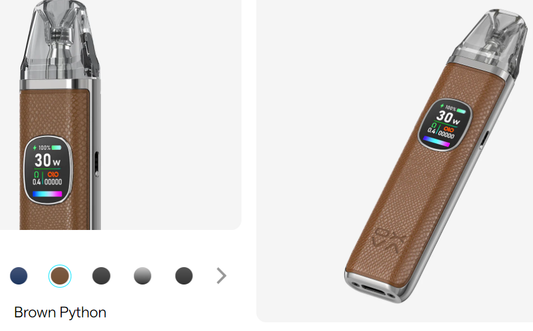

Oxva Xlim Go Pod Kit 30w Best Price In Pakistan

5.0 / 5.0

(11) 11 total reviews

Regular price Rs.3,999.00 PKRRegular priceUnit price / perRs.4,250.00 PKRSale price Rs.3,999.00 PKROxva Xlim Go Pod Kit 30w Best Price In Pakistan

Regular price Rs.3,999.00 PKRRegular priceUnit price / perRs.4,250.00 PKRSale price Rs.3,999.00 PKROxva Xlim Go Pod Kit 30w Best Price In Pakistan

Regular price Rs.3,999.00 PKRRegular priceUnit price / perRs.4,250.00 PKRSale price Rs.3,999.00 PKRSale -

Uwell Ak2 Price In Pakistan

Regular price Rs.3,450.00 PKRRegular priceUnit price / perRs.4,950.00 PKRSale price Rs.3,450.00 PKRSale -

OXVA NeXLIM Pod Kit 40Watts (1500mAh)

5.0 / 5.0

(3) 3 total reviews

Regular price Rs.7,900.00 PKRRegular priceUnit price / perOXVA NeXLIM Pod Kit 40Watts (1500mAh)

Regular price Rs.7,900.00 PKRRegular priceUnit price / perOXVA NeXLIM Pod Kit 40Watts (1500mAh)

Regular price Rs.7,900.00 PKRRegular priceUnit price / per -

GEEK VAPE WENAX Q PRO POD KIT 30W

5.0 / 5.0

(2) 2 total reviews

Regular price Rs.6,700.00 PKRRegular priceUnit price / perRs.9,000.00 PKRSale price Rs.6,700.00 PKRGEEK VAPE WENAX Q PRO POD KIT 30W

Regular price Rs.6,700.00 PKRRegular priceUnit price / perRs.9,000.00 PKRSale price Rs.6,700.00 PKRGEEK VAPE WENAX Q PRO POD KIT 30W

Regular price Rs.6,700.00 PKRRegular priceUnit price / perRs.9,000.00 PKRSale price Rs.6,700.00 PKRSale -

VAPORESSO ECO NANO 2 POD KIT AT BEST PRICE

Regular price Rs.4,450.00 PKRRegular priceUnit price / perRs.5,500.00 PKRSale price Rs.4,450.00 PKRVAPORESSO ECO NANO 2 POD KIT AT BEST PRICE

Regular price Rs.4,450.00 PKRRegular priceUnit price / perRs.5,500.00 PKRSale price Rs.4,450.00 PKRVAPORESSO ECO NANO 2 POD KIT AT BEST PRICE

Regular price Rs.4,450.00 PKRRegular priceUnit price / perRs.5,500.00 PKRSale price Rs.4,450.00 PKRSale -

VOOPOO Argus P2 Pod Kit 30W on Best Price at Mr.vapora

5.0 / 5.0

(17) 17 total reviews

Regular price Rs.6,850.00 PKRRegular priceUnit price / perRs.8,500.00 PKRSale price Rs.6,850.00 PKRVOOPOO Argus P2 Pod Kit 30W on Best Price at Mr.vapora

Regular price Rs.6,850.00 PKRRegular priceUnit price / perRs.8,500.00 PKRSale price Rs.6,850.00 PKRVOOPOO Argus P2 Pod Kit 30W on Best Price at Mr.vapora

Regular price Rs.6,850.00 PKRRegular priceUnit price / perRs.8,500.00 PKRSale price Rs.6,850.00 PKRSale -

Vaporesso XROS 4 Mini Pod Kit At Best Price

5.0 / 5.0

(10) 10 total reviews

Regular price Rs.5,500.00 PKRRegular priceUnit price / perVaporesso XROS 4 Mini Pod Kit At Best Price

Regular price Rs.5,500.00 PKRRegular priceUnit price / perVaporesso XROS 4 Mini Pod Kit At Best Price

Regular price Rs.5,500.00 PKRRegular priceUnit price / per -

Voopoo Argus Z2 Pod Kit 20 Watts (1500 mAh)

Regular price Rs.3,499.00 PKRRegular priceUnit price / perVoopoo Argus Z2 Pod Kit 20 Watts (1500 mAh)

Regular price Rs.3,499.00 PKRRegular priceUnit price / perVoopoo Argus Z2 Pod Kit 20 Watts (1500 mAh)

Regular price Rs.3,499.00 PKRRegular priceUnit price / per -

Oxva VPrime 60W Pod Mod Kit

Regular price Rs.9,950.00 PKRRegular priceUnit price / perRs.1,200.00 PKRSale price Rs.9,950.00 PKROxva VPrime 60W Pod Mod Kit

Regular price Rs.9,950.00 PKRRegular priceUnit price / perRs.1,200.00 PKRSale price Rs.9,950.00 PKROxva VPrime 60W Pod Mod Kit

Regular price Rs.9,950.00 PKRRegular priceUnit price / perRs.1,200.00 PKRSale price Rs.9,950.00 PKR -

Geekvape H45 (Aegis Hero 2) Pod Mod Kit 1400mah

Regular price Rs.11,900.00 PKRRegular priceUnit price / perGeekvape H45 (Aegis Hero 2) Pod Mod Kit 1400mah

Regular price Rs.11,900.00 PKRRegular priceUnit price / perGeekvape H45 (Aegis Hero 2) Pod Mod Kit 1400mah

Regular price Rs.11,900.00 PKRRegular priceUnit price / per -

Voopoo Argus GT 2 Starter Kit 200W

Regular price Rs.14,500.00 PKRRegular priceUnit price / perVoopoo Argus GT 2 Starter Kit 200W

Regular price Rs.14,500.00 PKRRegular priceUnit price / perVoopoo Argus GT 2 Starter Kit 200W

Regular price Rs.14,500.00 PKRRegular priceUnit price / per -

Voopoo Argus XT 100W Starter Kit at Best Price

Regular price Rs.10,500.00 PKRRegular priceUnit price / perVoopoo Argus XT 100W Starter Kit at Best Price

Regular price Rs.10,500.00 PKRRegular priceUnit price / perVoopoo Argus XT 100W Starter Kit at Best Price

Regular price Rs.10,500.00 PKRRegular priceUnit price / per -

Voopoo Vmate E2 Pod Kit 30 Watts At Best Price

Regular price Rs.7,650.00 PKRRegular priceUnit price / perRs.9,500.00 PKRSale price Rs.7,650.00 PKRVoopoo Vmate E2 Pod Kit 30 Watts At Best Price

Regular price Rs.7,650.00 PKRRegular priceUnit price / perRs.9,500.00 PKRSale price Rs.7,650.00 PKRVoopoo Vmate E2 Pod Kit 30 Watts At Best Price

Regular price Rs.7,650.00 PKRRegular priceUnit price / perRs.9,500.00 PKRSale price Rs.7,650.00 PKRSale -

Oxva Xlim Pro 2 Pod System Kit at Best Price

5.0 / 5.0

(8) 8 total reviews

Regular price Rs.7,000.00 PKRRegular priceUnit price / perRs.8,500.00 PKRSale price Rs.7,000.00 PKROxva Xlim Pro 2 Pod System Kit at Best Price

Regular price Rs.7,000.00 PKRRegular priceUnit price / perRs.8,500.00 PKRSale price Rs.7,000.00 PKROxva Xlim Pro 2 Pod System Kit at Best Price

Regular price Rs.7,000.00 PKRRegular priceUnit price / perRs.8,500.00 PKRSale price Rs.7,000.00 PKRSale -

Pava Horiz Ultra 1300 mAh Pod Kit Best Price In Pakistan

5.0 / 5.0

(1) 1 total reviews

Regular price Rs.10,000.00 PKRRegular priceUnit price / perPava Horiz Ultra 1300 mAh Pod Kit Best Price In Pakistan

Regular price Rs.10,000.00 PKRRegular priceUnit price / perPava Horiz Ultra 1300 mAh Pod Kit Best Price In Pakistan

Regular price Rs.10,000.00 PKRRegular priceUnit price / per -

Pava Horiz Pro Pod Kit at Best Price in Pakistan

Regular price Rs.8,000.00 PKRRegular priceUnit price / perPava Horiz Pro Pod Kit at Best Price in Pakistan

Regular price Rs.8,000.00 PKRRegular priceUnit price / perPava Horiz Pro Pod Kit at Best Price in Pakistan

Regular price Rs.8,000.00 PKRRegular priceUnit price / per -

GEEK VAPE AEGIS HERO Q POD KIT 30W

Regular price Rs.7,850.00 PKRRegular priceUnit price / perRs.9,500.00 PKRSale price Rs.7,850.00 PKRGEEK VAPE AEGIS HERO Q POD KIT 30W

Regular price Rs.7,850.00 PKRRegular priceUnit price / perRs.9,500.00 PKRSale price Rs.7,850.00 PKRGEEK VAPE AEGIS HERO Q POD KIT 30W

Regular price Rs.7,850.00 PKRRegular priceUnit price / perRs.9,500.00 PKRSale price Rs.7,850.00 PKRSale -

VAPORESSO GEN PT80S POD MOD KIT

Regular price Rs.8,900.00 PKRRegular priceUnit price / per

Nicsalt

-

Tokyo - Super Cool Pineapple Ice 35MG,50MG 30ML

5.0 / 5.0

(5) 5 total reviews

Regular price Rs.3,000.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.3,000.00 PKRSale -

VGOD DRY TOBACCO SALTNIC E-LIQUID 30ML

5.0 / 5.0

(5) 5 total reviews

Regular price Rs.2,500.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,500.00 PKRSale -

Drip Down Iced Series Watermelon Grape Ice 30ml (25/50 mg)

Regular price Rs.2,700.00 PKRRegular priceUnit price / per -

Sold out

Sold outDRIP DOWN FROSTY - 50MG - GRAPE ICE

Regular price Rs.3,200.00 PKRRegular priceUnit price / per -

BLVK Bubba Salt - Blue Razz Bubblegum Ice 30ml

Regular price Rs.3,200.00 PKRRegular priceUnit price / per -

TOKYO - ICED GRAPE 30ML

4.67 / 5.0

(3) 3 total reviews

Regular price Rs.2,600.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,600.00 PKRSale -

VGOD CUBANO BROWN RICH CREAMY CIGAR SALTNIC 30ML

5.0 / 5.0

(5) 5 total reviews

Regular price Rs.2,800.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,800.00 PKRSale -

Tokyo Crazy Fruits Guava Ice 35MG,50MG 30ML

5.0 / 5.0

(3) 3 total reviews

Regular price Rs.2,600.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,600.00 PKRSale -

TOKYO - PASSION FRUIT 30ML

5.0 / 5.0

(2) 2 total reviews

Regular price Rs.2,600.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,600.00 PKRSale -

DRIP DOWN FROSTY - 30ML - PASSION FRUIT ICE

5.0 / 5.0

(1) 1 total reviews

Regular price Rs.3,200.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.3,200.00 PKR -

TOKYO - ICED BLUBERRY WATERMELON 30ML

Regular price Rs.2,600.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,600.00 PKRSale -

VGOD - MELON MIX - 50MG 30ML

Regular price Rs.2,500.00 PKRRegular priceUnit price / perRs.0.00 PKRSale price Rs.2,500.00 PKR -

TOKYO - ICED CRANBERRY RASPBERRY 30ML

5.0 / 5.0

(1) 1 total reviews

Regular price Rs.2,600.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,600.00 PKRSale -

TOKYO GOLDEN - ORANGE PEACH ICE 30ML 30MG

Regular price Rs.2,600.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,600.00 PKRSale -

TOKYO - ICED STRAWBERRY LITCHI 30ML

Regular price Rs.2,600.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,600.00 PKRSale -

TOKYO - ICED LEMON 20MG,30MG,50MG 30ML

5.0 / 5.0

(2) 2 total reviews

Regular price Rs.2,600.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,600.00 PKRSale -

JUICE HEAD - STRAWBERRY KIWI EXTRA FREEZE 30ML

5.0 / 5.0

(1) 1 total reviews

Regular price Rs.2,750.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,750.00 PKRSale -

PODSALT 50MG 30ML - FUJI APPLE PEACH

Regular price Rs.3,200.00 PKRRegular priceUnit price / per -

PODSALT 25MG 30ML - PINEAPPLE PASSION LIME

Regular price Rs.3,200.00 PKRRegular priceUnit price / per -

VGOD - MIGHTY MINT - 50MG 30ML

Regular price Rs.2,500.00 PKRRegular priceUnit price / perRs.3,200.00 PKRSale price Rs.2,500.00 PKRSale

Coils & Pods

-

VOOPOO VMATE TOP FILL CARTRIDGE 3ML

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

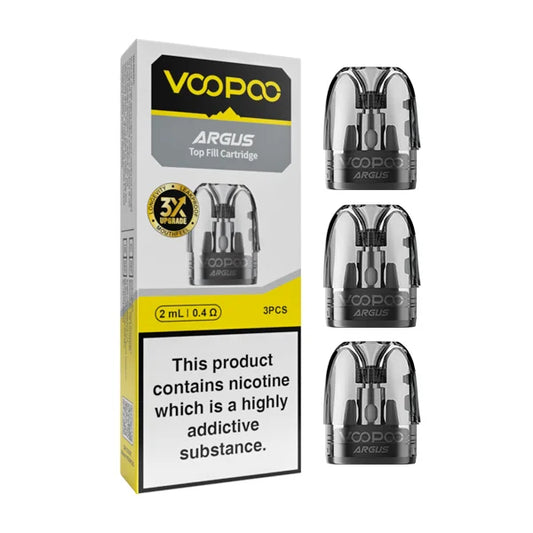

VOOPOO ARGUS TOP FILL CARTRIDGE 3ML

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

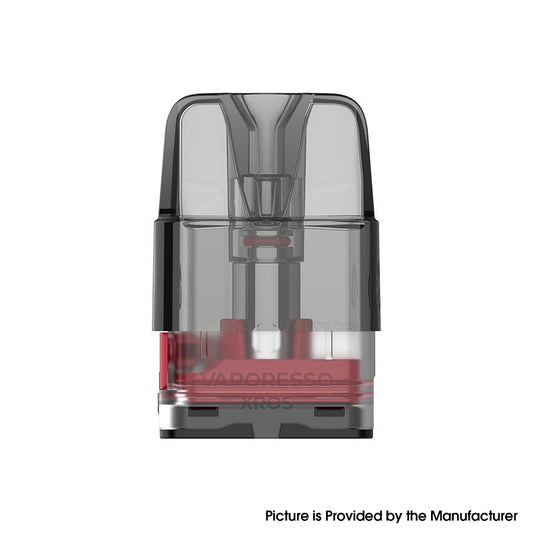

Vaporesso ECO Nano Pod Cartridge

Regular price From Rs.850.00 PKRRegular priceUnit price / perRs.1,000.00 PKRSale price From Rs.850.00 PKRSale -

OXVA - XLIM V2 CARTIDGES

5.0 / 5.0

(2) 2 total reviews

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

VAPORESSO - XROS SERIES 0.7 MESH POD

5.0 / 5.0

(4) 4 total reviews

Regular price From Rs.800.00 PKRRegular priceUnit price / per -

VAPORESSO - XROS SERIES 0.6 MESH POD 3ML

5.0 / 5.0

(1) 1 total reviews

Regular price From Rs.800.00 PKRRegular priceUnit price / per -

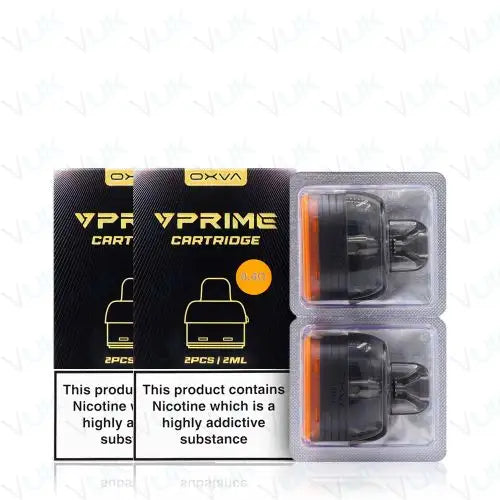

OXVA VPRIME POD CATRIDGES

Regular price From Rs.950.00 PKRRegular priceUnit price / perRs.1,000.00 PKRSale price From Rs.950.00 PKRSale -

Lost Vape Ursa Cartridges

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

Buy Uwell Caliburn A2 / A2S Replacement Pods At Best Price In Pakistan

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

OXVA Oneo Pod Cartridge 3.5ml

Regular price From Rs.900.00 PKRRegular priceUnit price / per -

GEEKVAPE N CATRIDGE 0.6 20-25W AT BEST PRICE

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

OXVA Artio Refillable Pod 0.8 OHMS

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

Uwell Caliburn A3 Refilling Pod

5.0 / 5.0

(2) 2 total reviews

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

Vaporesso Luxe Q Replacement Mesh Pods

Regular price From Rs.500.00 PKRRegular priceUnit price / per -

XROS 0.4 REPLACEMENT POD

5.0 / 5.0

(2) 2 total reviews

Regular price Rs.850.00 PKRRegular priceUnit price / per -

SMOK - RPM 3 MESH COIL 0.15 OHM

5.0 / 5.0

(1) 1 total reviews

Regular price From Rs.900.00 PKRRegular priceUnit price / per -

GEEKVAPE - REPLACMENT Q PODS

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

SMOK – RPM80 RGC COIL – DC 0.8

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

SMOK - RPM COIL MTL MESH 0.3

Regular price From Rs.850.00 PKRRegular priceUnit price / per -

RPM COIL - QUARTZ 1.2

Regular price From Rs.700.00 PKRRegular priceUnit price / per

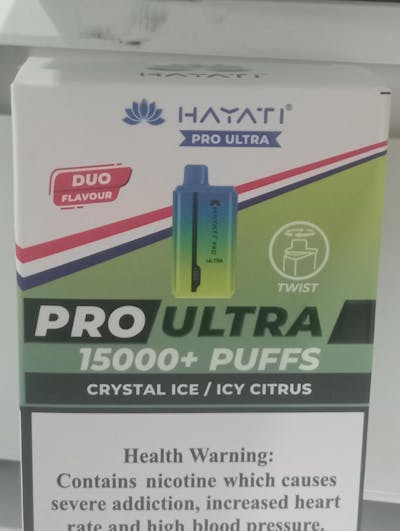

Disposables

-

HAYATI PRO ULTRA LEMON & LIME / BLUE RAZZ & MINT 15000 PUFFS

Regular price Rs.5,250.00 PKRRegular priceUnit price / perRs.6,500.00 PKRSale price Rs.5,250.00 PKRSale -

HAYATI PRO ULTRA STRAWBERRY WATERMELON 15000 PUFFS

Regular price Rs.5,250.00 PKRRegular priceUnit price / perRs.6,500.00 PKRSale price Rs.5,250.00 PKRSale -

HAYATI PRO ULTRA BLACKCURRENT LEMONADE/ STRAW' LEMONADE 15000 PUFFS

Regular price Rs.5,250.00 PKRRegular priceUnit price / perRs.6,500.00 PKRSale price Rs.5,250.00 PKRSale -

HAYATI PRO ULTRA 15000 PUFFS

4.33 / 5.0

(12) 12 total reviews

Regular price Rs.5,250.00 PKRRegular priceUnit price / perRs.6,500.00 PKRSale price Rs.5,250.00 PKRSale -

MLife Disposables 6000 Puffs 50mg at Best Price

Regular price Rs.2,450.00 PKRRegular priceUnit price / perRs.3,150.00 PKRSale price Rs.2,450.00 PKRSale -

BLVK Bar 20K Puffs 5% at Best Price

5.0 / 5.0

(4) 4 total reviews

Regular price Rs.5,500.00 PKRRegular priceUnit price / perRs.6,000.00 PKRSale price Rs.5,500.00 PKRSale -

POP DISPOSABLE 2% & 5%

5.0 / 5.0

(1) 1 total reviews

Regular price Rs.2,000.00 PKRRegular priceUnit price / per -

Sale

SaleIVG REGAL 6000 20MG

5.0 / 5.0

(1) 1 total reviews

Regular price Rs.3,750.00 PKRRegular priceUnit price / perRs.4,500.00 PKRSale price Rs.3,750.00 PKRSale -

SLUGGER 6000PUFFS 40MG

Regular price Rs.3,799.00 PKRRegular priceUnit price / per -

Ivg 8k Puffs 3.5% Mg Disposable At Best Price In Pakistan

5.0 / 5.0

(1) 1 total reviews

Regular price Rs.4,000.00 PKRRegular priceUnit price / per -

Al Fakher Crown Bar 12k Puffs Disposable Vape with Integrated Hookah Soundwaves

Regular price Rs.4,450.00 PKRRegular priceUnit price / perRs.5,500.00 PKRSale price Rs.4,450.00 PKRSale -

AL FAKHER DISPOSABLE 8000 PUFFS

Regular price Rs.3,800.00 PKRRegular priceUnit price / perRs.4,800.00 PKRSale price Rs.3,800.00 PKRSale -

HAYATI PRO MAX 4000 PUFFS AT BEST PRICE

Regular price From Rs.4,200.00 PKRRegular priceUnit price / perRs.6,000.00 PKRSale price From Rs.4,200.00 PKRSale -

Elffbar Fs 18000 Puffs Disposable 5%

Regular price From Rs.4,900.00 PKRRegular priceUnit price / per -

IVG FUSION 2 IN 1 DISPOSABLE 15000 PUFFS 20MG

Regular price Rs.4,000.00 PKRRegular priceUnit price / perRs.6,000.00 PKRSale price Rs.4,000.00 PKRSale -

TOMORROW LAND 3MG - DRIP DOWN BOLD MAX DISPOSABLE 15000 PUFFS

Regular price Rs.3,450.00 PKRRegular priceUnit price / perRs.4,350.00 PKRSale price Rs.3,450.00 PKRSale -

HAYATI PRO ULTRA GRAPE GUMMY BEAR / STRAW' GUMMY BEAR 15000 PUFFS

Regular price Rs.5,250.00 PKRRegular priceUnit price / perRs.6,500.00 PKRSale price Rs.5,250.00 PKRSale -

Skipper Powerplay 800mAh Rechargeable Battery

5.0 / 5.0

(1) 1 total reviews

Regular price Rs.1,850.00 PKRRegular priceUnit price / perRs.2,000.00 PKRSale price Rs.1,850.00 PKRSale -

PASSION FRUIT GUAVA 3MG - DRIP DOWN BOLD MAX DISPOSABLE 15000 PUFFS

Regular price Rs.3,450.00 PKRRegular priceUnit price / perRs.4,350.00 PKRSale price Rs.3,450.00 PKRSale -

HAYATI PRO ULTRA STRAW GUAVA / DRAGON BERIES 15000 PUFFS

Regular price Rs.5,250.00 PKRRegular priceUnit price / perRs.6,500.00 PKRSale price Rs.5,250.00 PKRSale

E-Liquid

-

DRVAPES-BUBBLEGUM KINGS WATERMELON ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-BUBBLEGUM KINGS WATERMELON ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-BUBBLEGUM KINGS WATERMELON ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-BUBBLEGUM KINGS ORIGIONAL ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-BUBBLEGUM KINGS ORIGIONAL ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-BUBBLEGUM KINGS ORIGIONAL ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-PINK FROZEN CRAZY 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PINK FROZEN CRAZY 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PINK FROZEN CRAZY 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-PINK FROZEN SMOOTHIE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PINK FROZEN SMOOTHIE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PINK FROZEN SMOOTHIE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-PINK FROZEN REMIX 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PINK FROZEN REMIX 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PINK FROZEN REMIX 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-GREEN PANTHER EMERLAND ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-GREEN PANTHER EMERLAND ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-GREEN PANTHER EMERLAND ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-GOLD PANTHER 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-GOLD PANTHER 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-GOLD PANTHER 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-TOBACCO KINGS 6MG-60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-BLACK PANTHER 6MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-BLACK PANTHER 6MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-BLACK PANTHER 6MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-BLUE PANTHER ORIGIONAL 3MG-60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DR-VAPES BLACK CUSTARD 3MG,6MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDR-VAPES BLACK CUSTARD 3MG,6MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDR-VAPES BLACK CUSTARD 3MG,6MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-BUBBLEGUM KINGS COLA ICE 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-BUBBLEGUM KINGS COLA ICE 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-BUBBLEGUM KINGS COLA ICE 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-PINK FROZEN ROYALE 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PINK FROZEN ROYALE 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PINK FROZEN ROYALE 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

BLUE PANTHER FROZEN 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRBLUE PANTHER FROZEN 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRBLUE PANTHER FROZEN 3MG,12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-PANTHER RED APPLE ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PANTHER RED APPLE ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PANTHER RED APPLE ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-PANTHER PEACH ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PANTHER PEACH ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PANTHER PEACH ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-PANTHER MANGO ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PANTHER MANGO ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PANTHER MANGO ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

DRVAPES-PANTHER BERRIES ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PANTHER BERRIES ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRDRVAPES-PANTHER BERRIES ICE 12MG,18MG 60ML

Regular price Rs.2,900.00 PKRRegular priceUnit price / perRs.3,300.00 PKRSale price Rs.2,900.00 PKRSale -

LOTUS CHEESECAKE 3MG-120ML

Regular price Rs.5,500.00 PKRRegular priceUnit price / per -

PINK FROZEN SMOOTHIE 3MG-120ML

Regular price Rs.5,500.00 PKRRegular priceUnit price / per

Multimedia Catalog

Tokyo - Super Cool Pineapple Ice 35MG,50MG 30ML

Award Winning

BLVK 20000 PUFFS DISPOSABLE

Experience Precision and Control with NIO-X™ Dual Coil System.3 VARIABLE VOLTAGE POWER MODES.ANTI-FLAVOR BURNING PROTECTION.DYNAMIC AIRFLOW CONTROL.CHILD RESISTANT FEATURES

Disposable

Hayati Ultra Pro

"Introducing the Award-Winning Hayati Ultra 15000 Puffs: Exclusively Available at MrVapora Pakistan"

In the ever-evolving world of vaping, the Hayati Ultra Promax 15000 Puffs stands out as a beacon of innovation and quality. This award-winning vape device, renowned for its superior performance and exceptional longevity, has now made its debut in Pakistan, exclusively available through MrVapora. For enthusiasts and connoisseurs alike, this represents an unparalleled opportunity to experience a top-tier product at an outstanding price.

PodKits

Al Fakher Crown Bar 12k Puffs Disposable Vape with Integrated Hookah Soundwaves

Experience the traditional hookah with the cutting-edge Al Fakher 12000 Puffs Disposable Vape. This device blends rich, authentic hookah soundwaves with modern vaping technology, offering up to 12000 puffs from a rechargeable battery and 0.6 Ohm mesh coils for dense vapour. Featuring a digital display for battery and oil monitoring, it comes in over 20 flavours!

Subscribe to our emails

Be the first to know about new collections and exclusive offers.

Let customers speak for us

from 320 reviews

Thanks for such a amazing product

Another wonderful product and service too

Highly recommended Thanks MR .Vapora for such a amazing product

It was nice using it

Really good vape. Smooth hits, great flavors, and long battery life. Easy to use and works perfectly.

Very good service by mr vapora

Received my order within an hour of placing. Vape was amazing

Best

Best device ever Nord 5 kit 💞

Best 👌

Best product

Taste is perfect battery timing is perfect but all the game is about its display

Blvk Makes a Very Strong entry after so Long but its worth it Hats off Mrvapora to Bring blvk back 🌟

It's my first visit at MrVapora after bought this I am totally satisfied 💕

Buying from uk now finally in Pakistan thanks mrvapora to bring the hayati

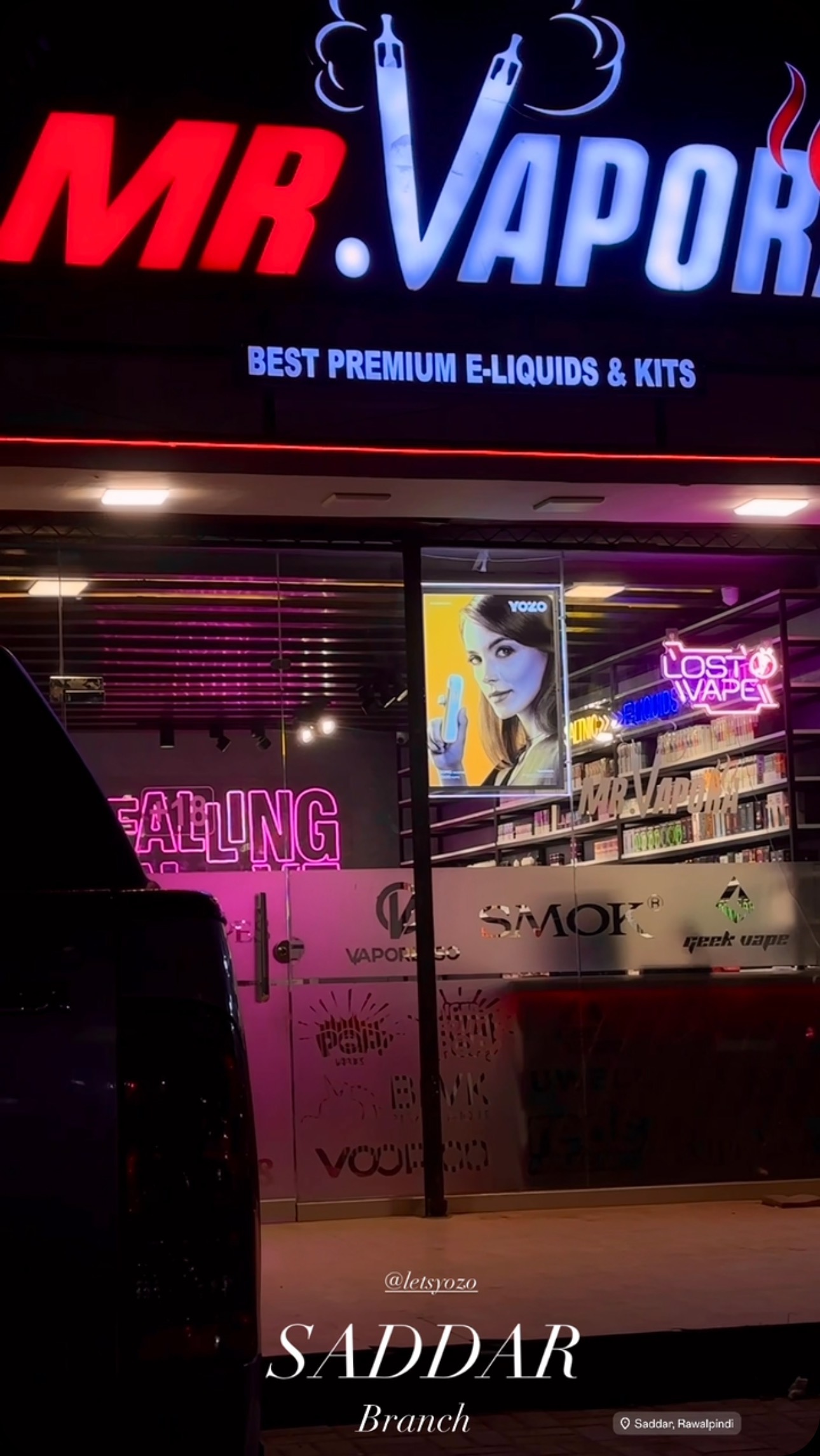

What customers think about the store

MrVapora is a highly rated vape shop offering a wide variety of authentic e-liquids, devices, and accessories at reasonable prices. Customers praise the knowledgeable and friendly staff, excellent customer service, fast delivery, and overall great shopping exp... MrVapora is a highly rated vape shop offering a wide variety of authentic e-liquids, devices, and accessories at reasonable prices. Customers praise the knowledgeable and friendly staff, excellent customer service, fast delivery, and overall great shopping experience.

Read more